(Study) For companies, the metaverse business is too niche

Published on: 27 Sep 2022 | Author: Aline Strouvens

Published on: 27 Sep 2022 | Author: Aline Strouvens

The concept of the metaverse space, a virtual shared environment where people interact with digital assets and engage in creative and immersive experiences, has swiftly evolved from science fiction to a plausible reality. As this technology gains momentum, businesses worldwide are closely observing the whole metaverse business: its potential impact on global metaverse markets and how it can revolutionize their operations, customer engagement, and the future of commerce.

This is the first Metaverse For Business study from Sortlist, an in-depth survey about companies’ views and investments in the metaverse. After surveying 200 of these companies across Europe and the USA about their digital strategy regarding the metaverse, we can how deep the rabbit hole goes and discover how the metaverse is turning into, presumably, a privileged playground that any advertising or social media marketing agency would want to tackle.

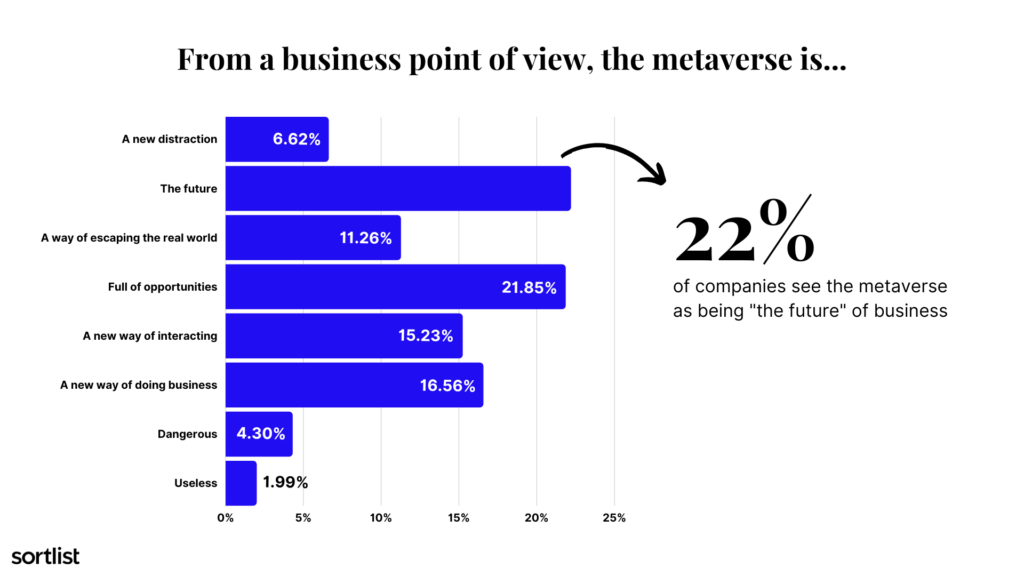

When asked why they started to invest in it, the surveyed companies highlighted that the metaverse is “the future” (22%).

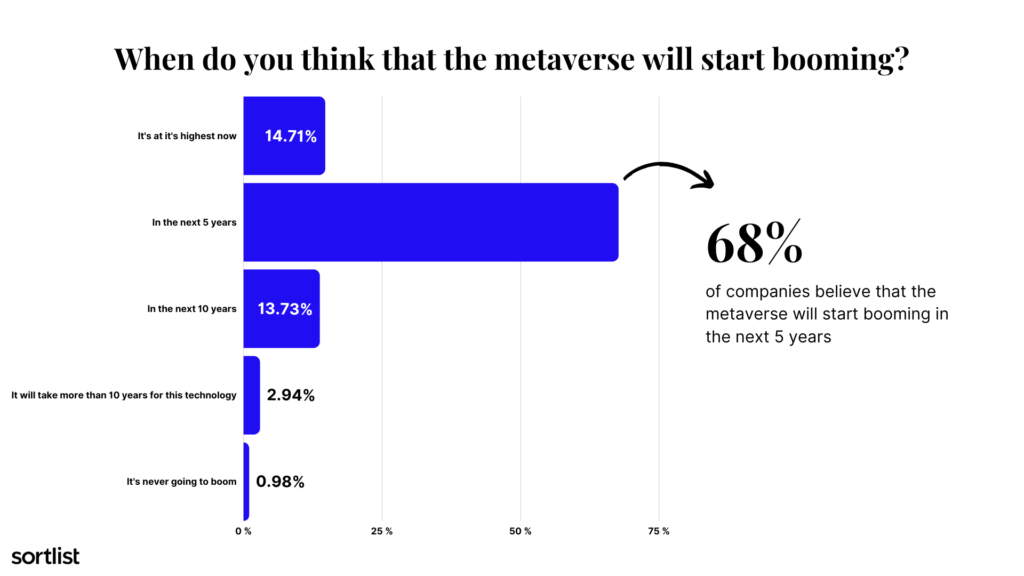

The confidence that brands have in the metaverse is so high that less than 3% believe the metaverse will need more than 10 years to reach worldwide consumption.

Most (68%) believe it will boom in the next 5 years.

76% believe that all types of industries will have an opportunity inside the virtual world.

Enterprises envision the metaverse space as a gateway to access previously a untapped territory: the global metaverse market. With augmented reality breaking down geographical barriers, businesses can now engage customers from diverse locations, transcending physical limitations. They foresee the potential for expanded consumer bases and the establishment of new revenue streams within this virtual realm.

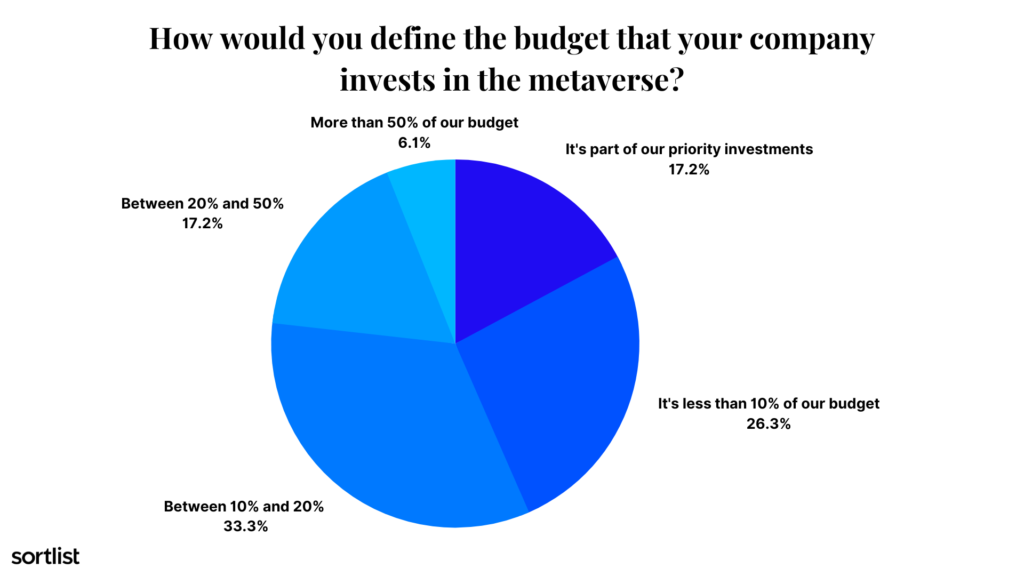

When asked to define the budget they reserved for metaverse projects, a third of companies claimed it was approximately 10-20% of it.

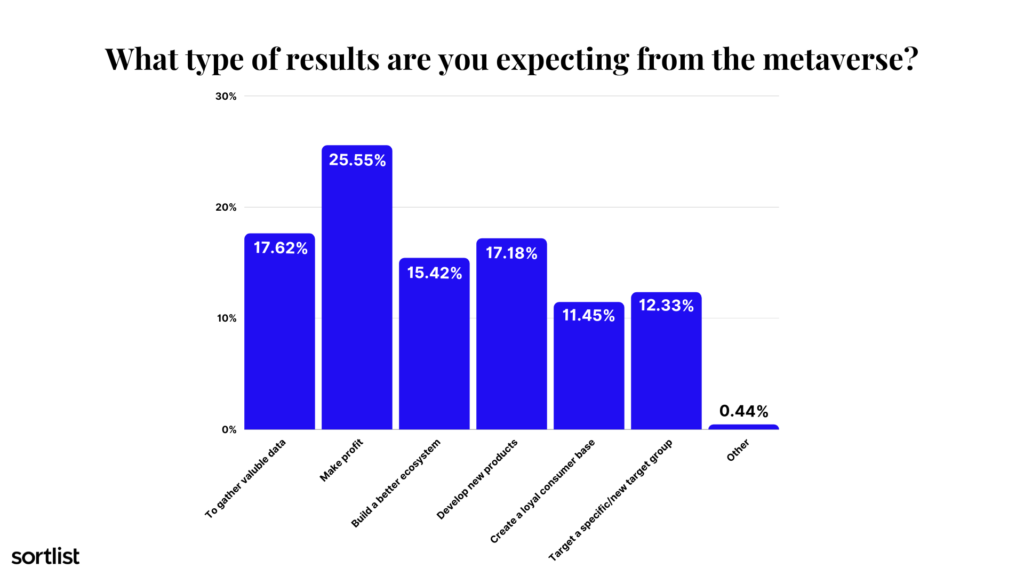

Despite the fact that 20% of users see the metaverse, and any virtual world, as a “way of escaping the real world,” in practice it has proven to be entirely the opposite for brands, who tend to believe (26%) that a journey into virtual worlds will yield something more than just entertainment for customers: profit, without a doubt worth more than a virtual reality.

Digital twin rendering software will play a pivotal role in the metaverse platform. This software empowers developers to construct intricate and immersive virtual environments, seamlessly bridging the gap between the metaverse world and the physical world.

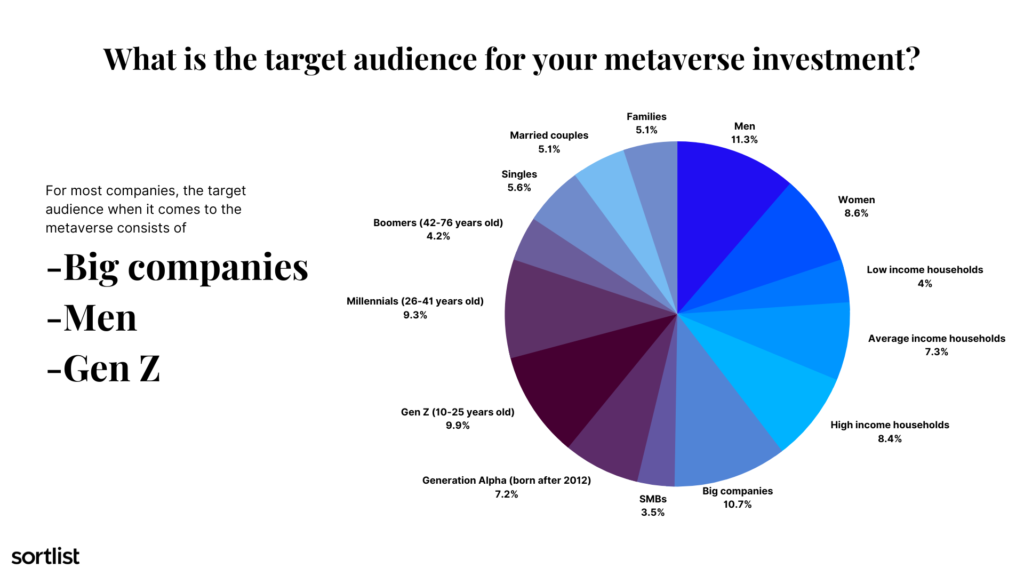

Companies that have invested in metaverse understand that this new virtual reality is directed mostly towards:

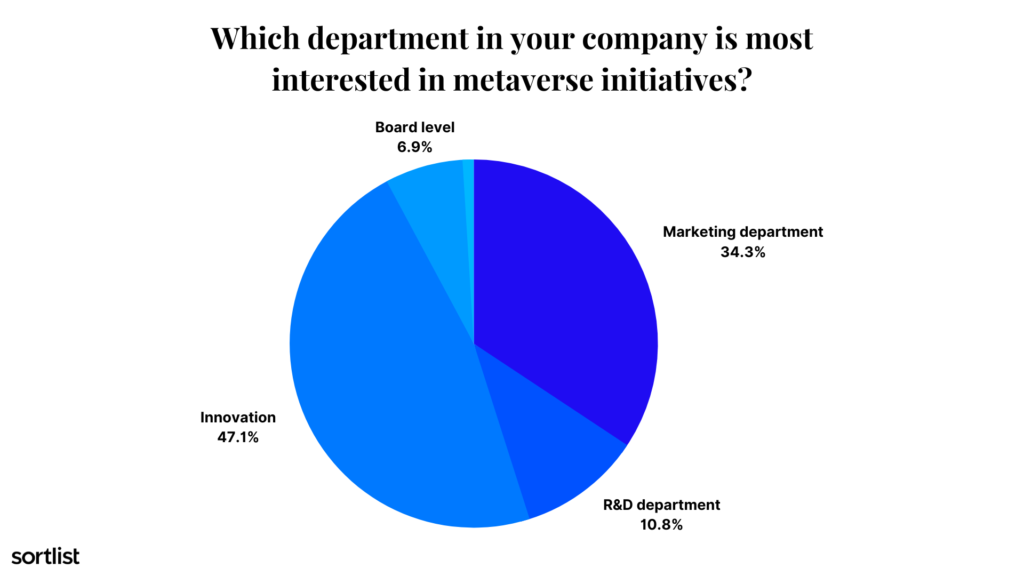

47% of brands already investing in the metaverse affirm that it is their innovation departments that are most interested in metaverse initiatives.

This proves that companies are ready for new technologies in the field, but also stresses an important reality: innovation departments are a trademark of bigger companies.

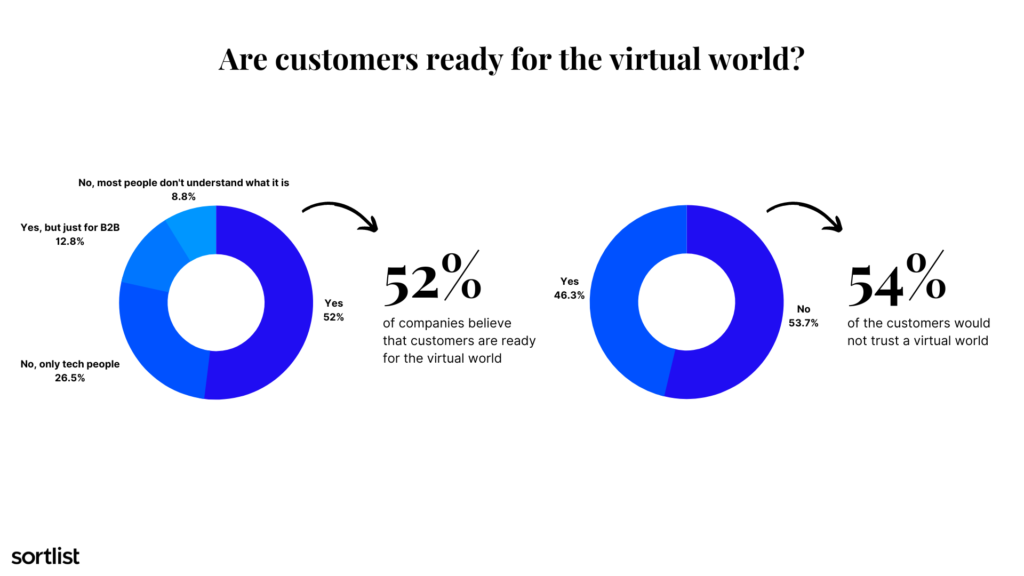

52% of the businesses surveyed think customers are ready for the metaverse, while our general survey says a significant 54% of users would not trust a virtual world.

It makes us wonder… will businesses address trust issues when it comes to advertising in the metaverse?

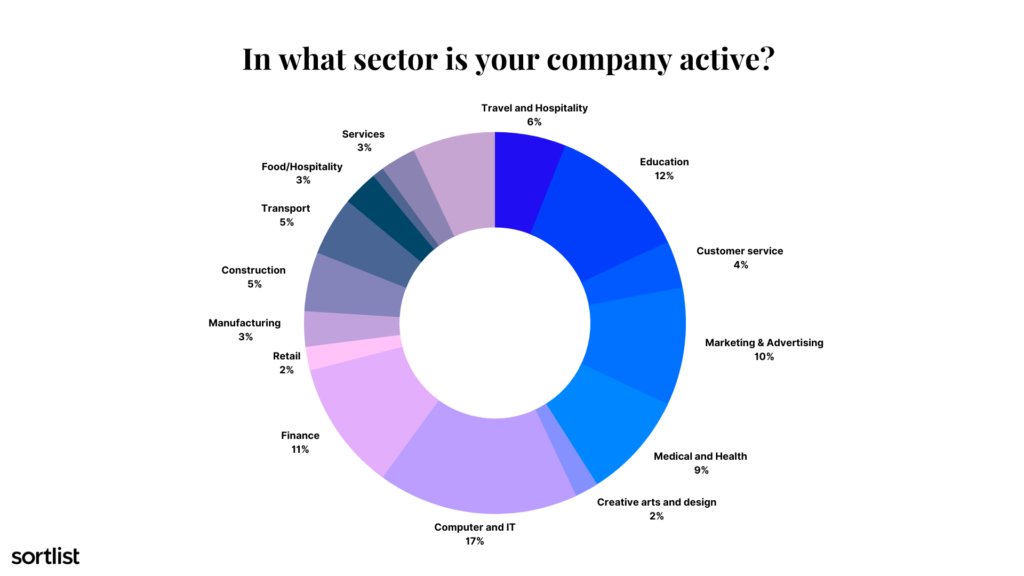

The industries of IT (17%) and education (12%) are the predominant sectors investing in the metaverse.

They are followed by the industries of finance (11%) and marketing and advertising (10%), confirming the massive potential that businesses see in the metaverse as another income stream.

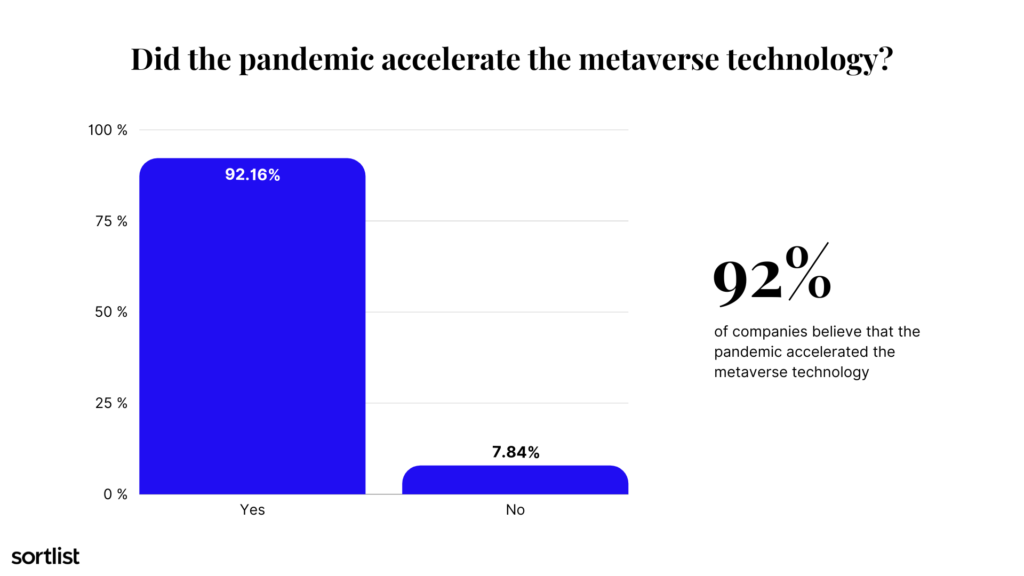

The combination of the health crisis and the need of companies to achieve digital transformation boosted interest in the metaverse as a business opportunity.

A stellar 92% of companies surveyed said that the pandemic accelerated the metaverse technology.

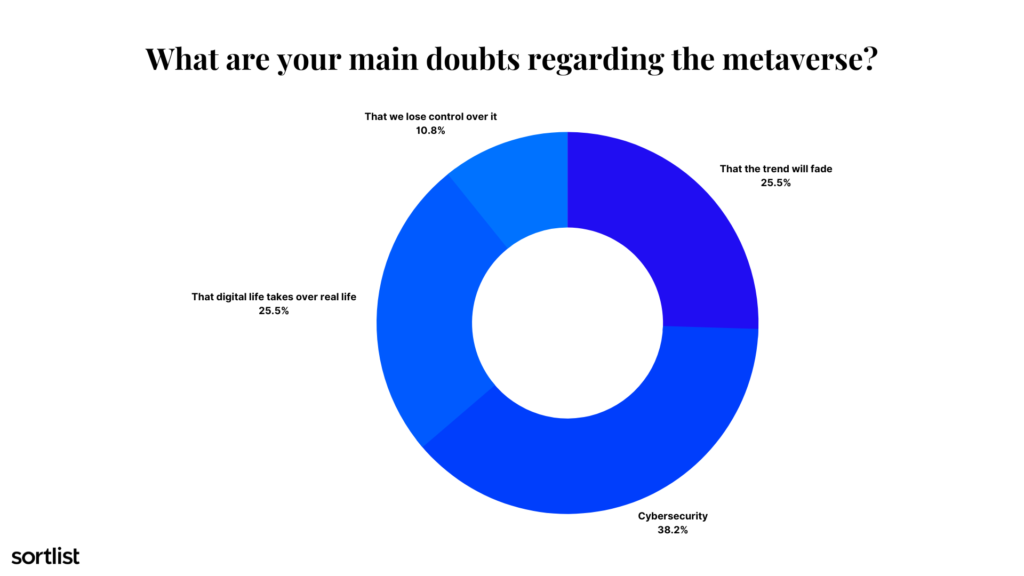

Cybersecurity stands out as the main doubt that companies have with the metaverse, with 38% of brands worried about their business’ security and data, and those of their customers.

It is placed ahead of worries like having the metaverse trend fade (25%) or, even, that digital life takes over real life (25%).

The concept of a metaverse has been alive and kicking for more than 20 years.

Today, thanks to the power of technology, we can finally see how that reality is starting to grow, and companies are watching along with it.

However, that vision today seems skewed. Investment risks have been acknowledged, but brands seem to think it is space for only a handful of users. We will accompany brands in studying the development of this virtual world, but so far, it appears that, for all its vastness, the metaverse seems to be thriving in a bubble.

The study was conducted between February 24th and March 1st, 2022, among 200 companies that have already invested in the metaverse. The surveyed companies came from Belgium, Germany, Spain, France, the United Kingdom, and the United States. We specifically targeted employed individuals above the age of 25 that occupied C-level positions such as executives, presidents, CEOs, board members, and senior management. The responses are anonymous.

The Sortlist Data Hub is the place to be for journalists and industry leaders who seek data-driven reports from the marketing world, gathered from our surveys, partner collaborations, and internal data of more than 50,000 industries.

It is designed to be a space where the numbers on marketing are turned into easy-to-read reports and studies.