Finance Influencers Have a Positive Impact on 50% of People

Published on: 27 Sep 2022 | Author: Aline Strouvens

Published on: 27 Sep 2022 | Author: Aline Strouvens

At Sortlist we decided to survey 1,000 people following finance and wealth influencers, with the aim to understand the power those social media influencers have on people’s decisions and how they compare to traditional wealth advisors and specialists. Here’s what we found.

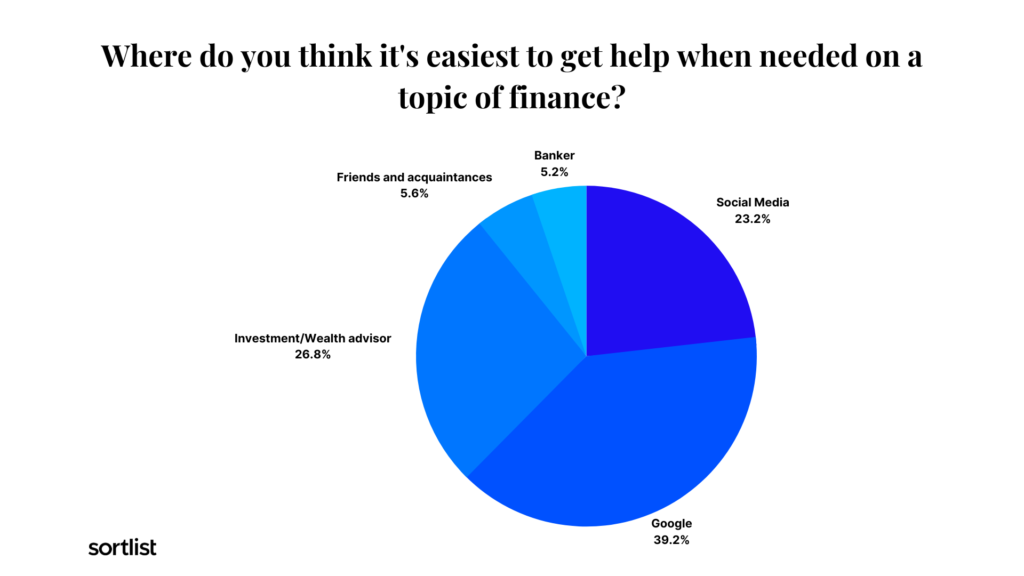

Alongside specialists, Google remains people’s easiest source of financial information.

Exactly 39.2% prefer to use Google, while 26.8% prefer to consult their investment or finance advisor.

However, the majority of older users (45-54 years old) still view their banker or wealth specialist as the main source.

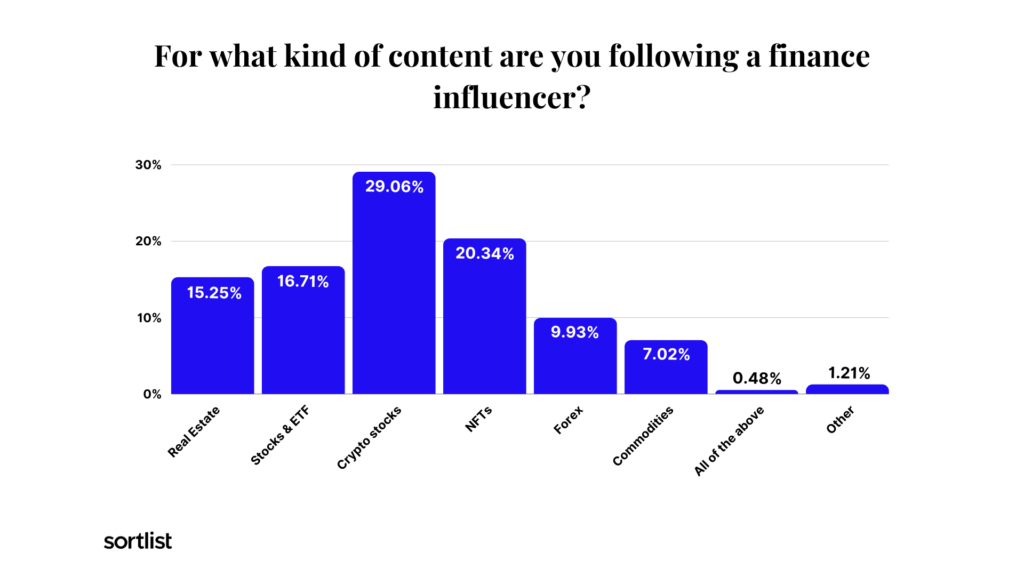

Our survey revealed that, in finance, people across all markets follow influencers for crypto stocks (29.06%) investment information.

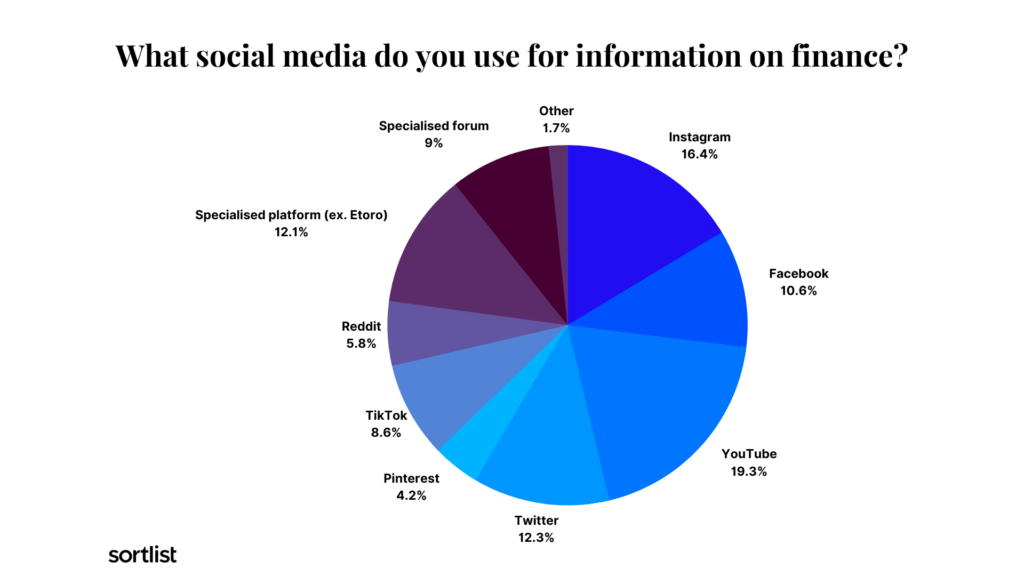

YouTube and Instagram are the social media channels that garner finance influencers most of their followers in their digital strategy.

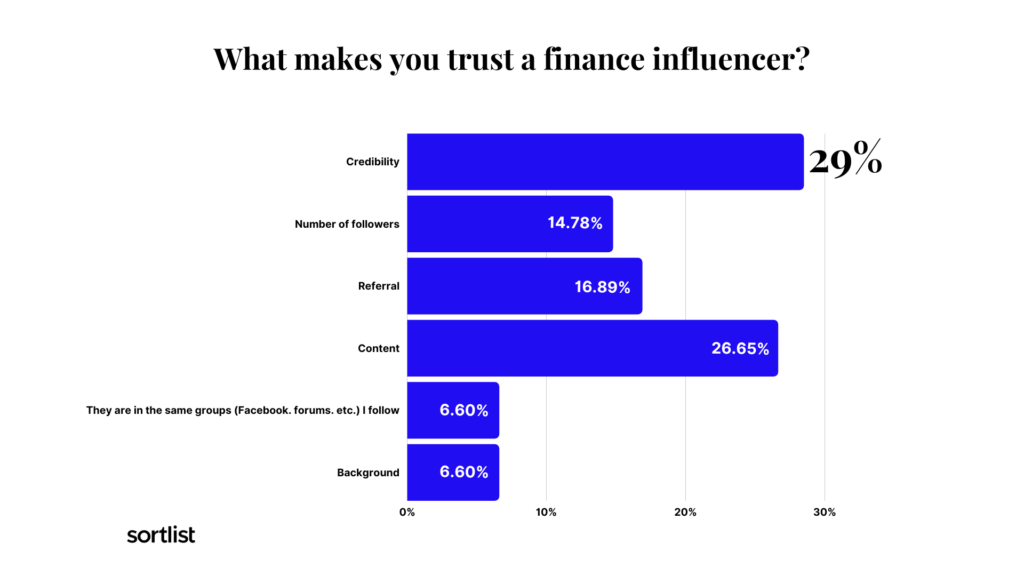

In every country surveyed, credibility stands as the most crucial element that make people trust a finance influencer.

In the finance industry, content and referrals are more important than the number followers.

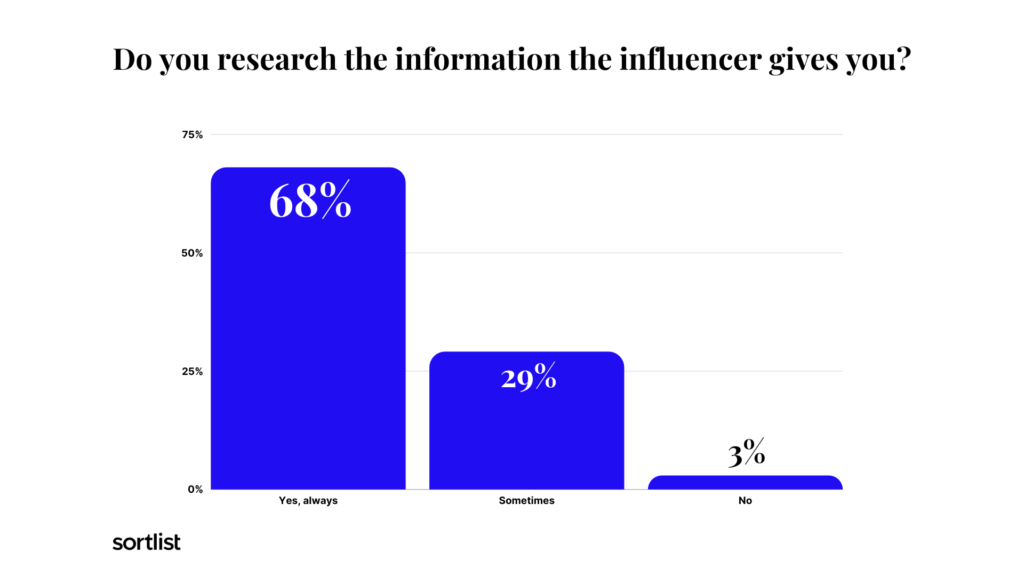

Only 30% of people claim to sometimes research the background information of finance influencers.

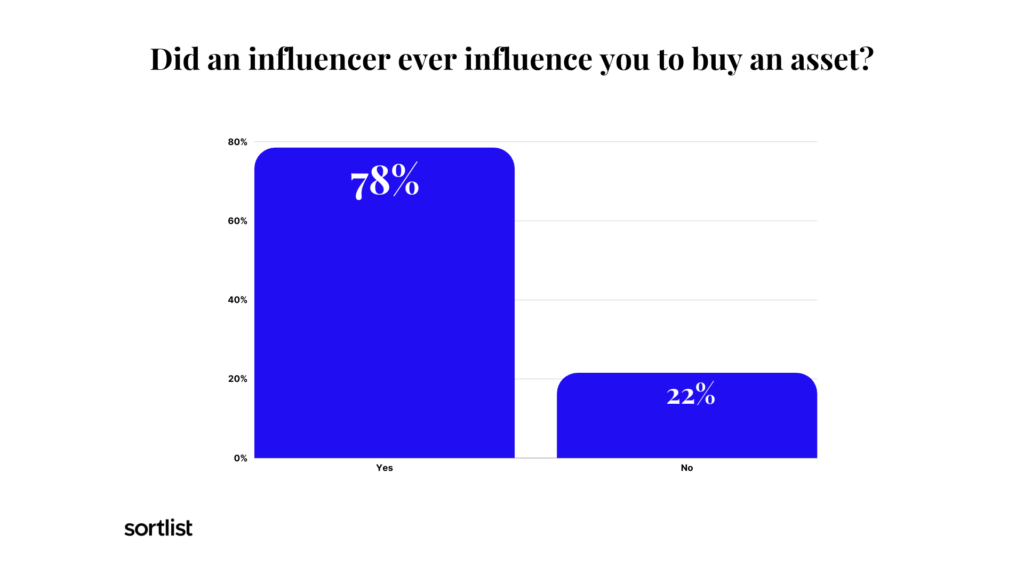

78.49% of people say that financial influencers have convinced them to buy an asset.

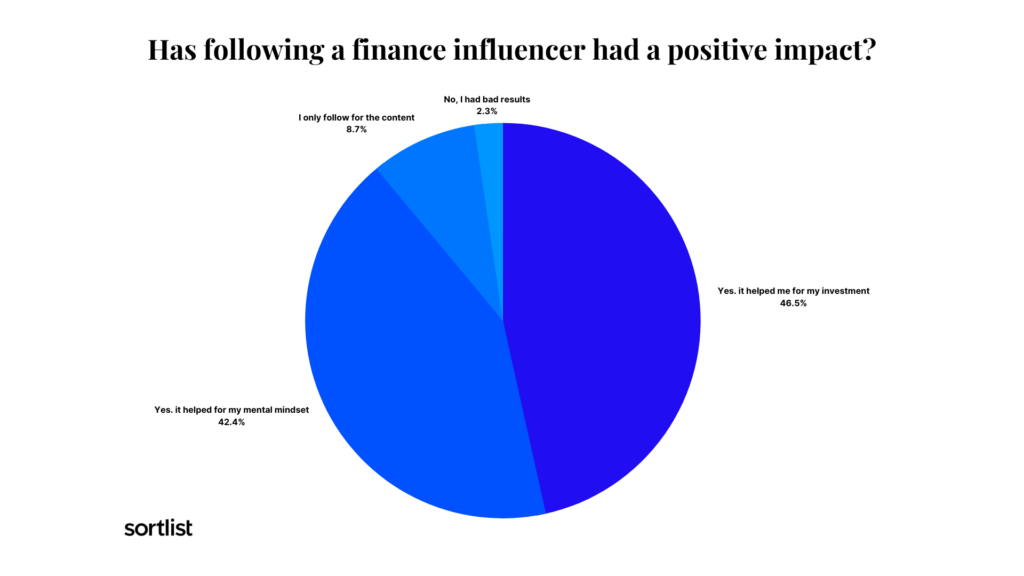

An overwhelming 46.51% of respondents claimed that financial influencers’ help had a positive impact on investment decisions, while 42.44% say they helped their financial mindset.

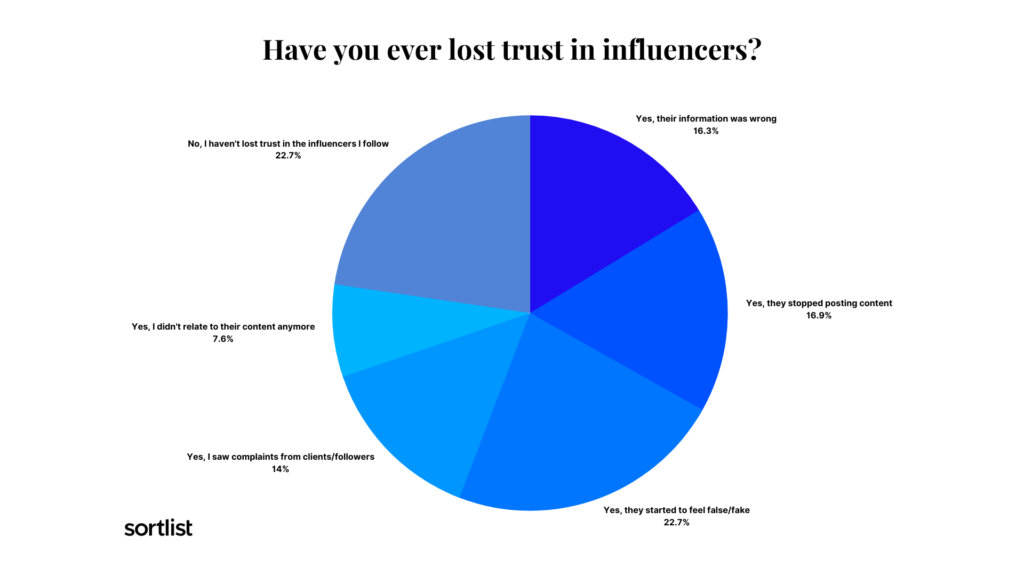

Other than the sense of feeling fake or false, users have virtually no reason to lose trust in the finance influencers they follow.

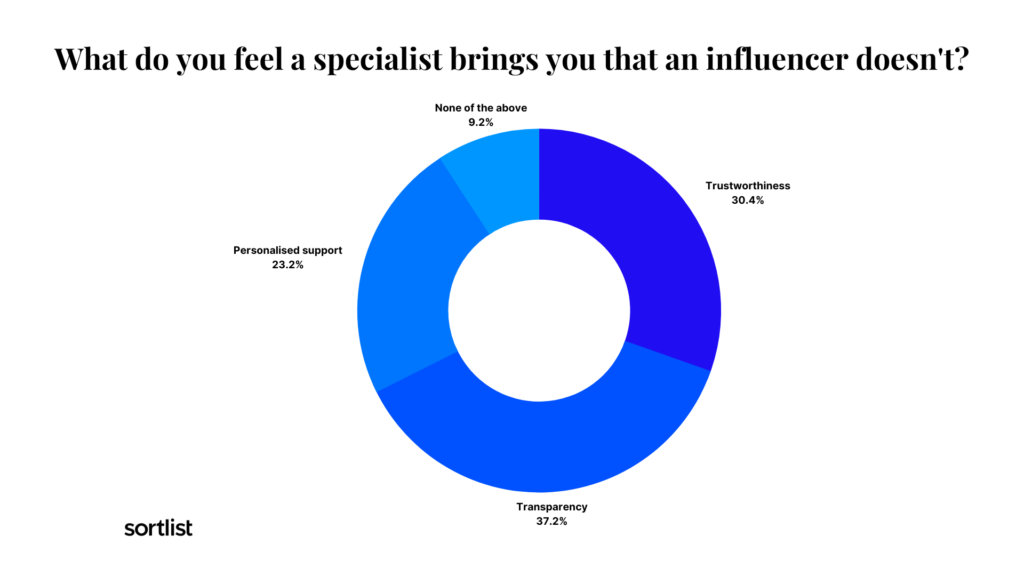

In finance, people trust specialists to be trustworthy, give a personalized service, and be transparent, more than they do influencers.

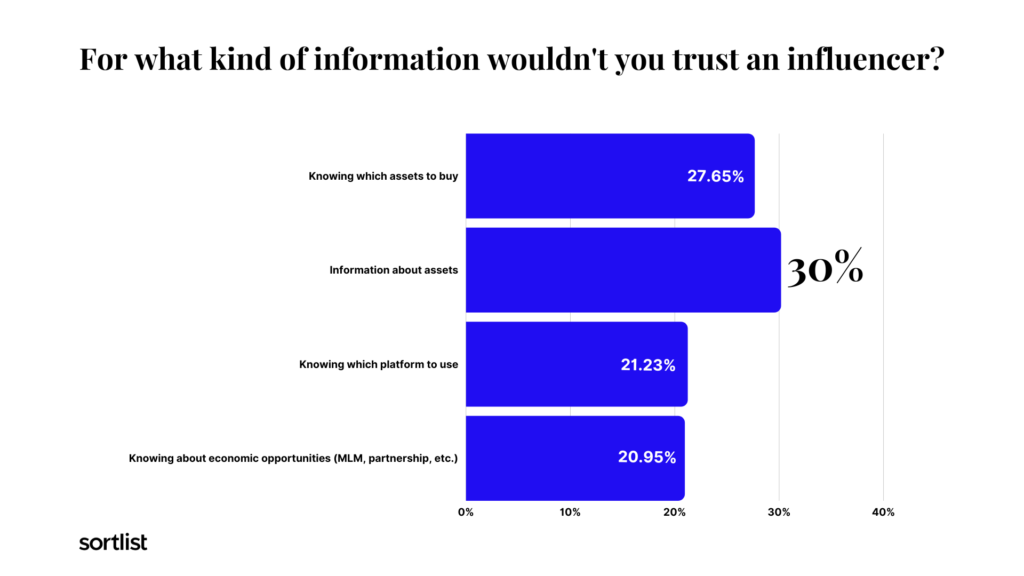

There are things that people simply wouldn’t trust an influencer with.

In finance, these can be issues related to knowing which assets to buy (27.65%) and what platforms to use (21.23%).

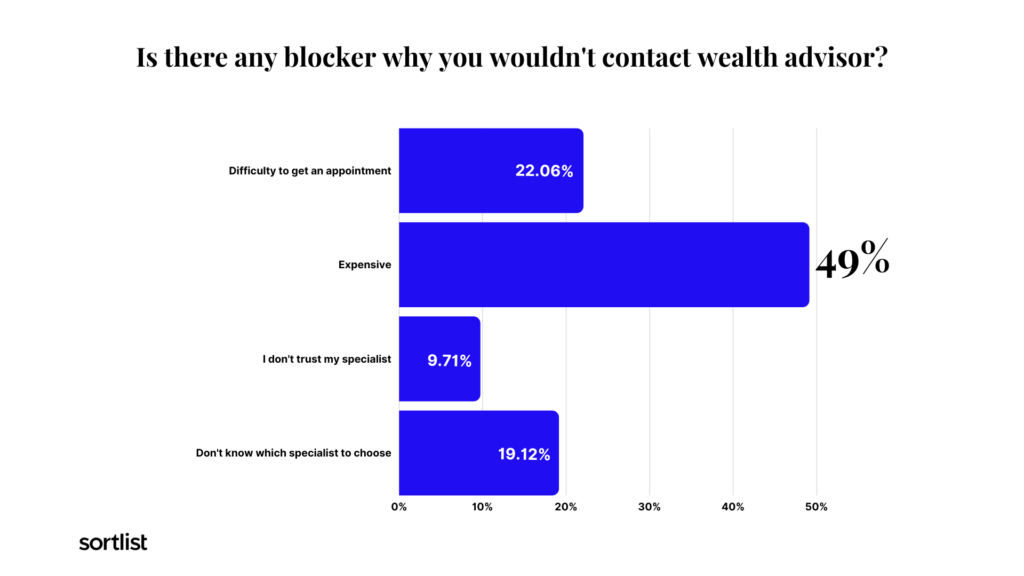

Most users feel that the cost of wealth specialists (49.12%) and their ease of access (22.06%) are the main blockers that stop them from reaching out to them.

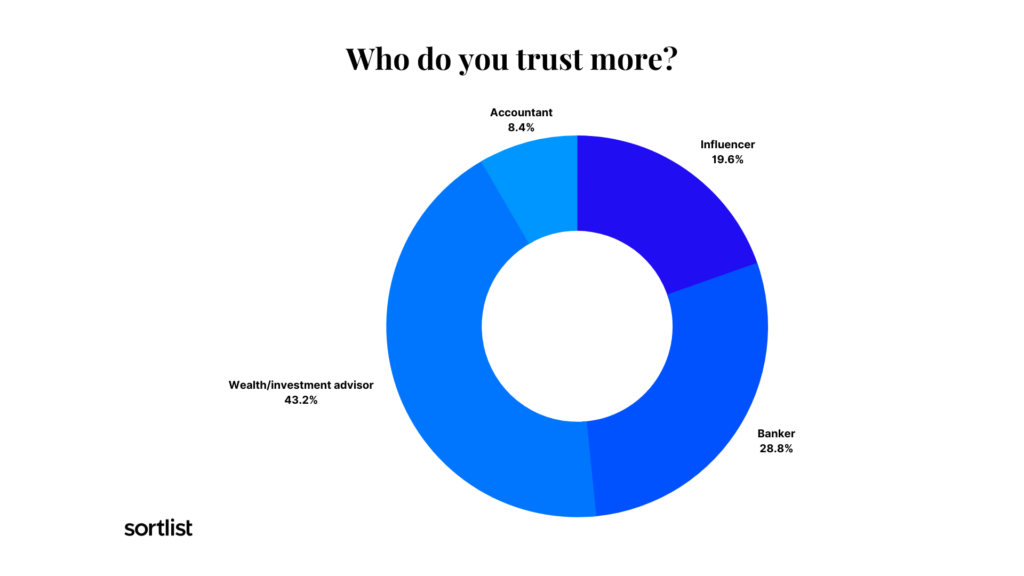

Only 1 out of 5 people would trust finance influencers before specialists, meaning the former still have a long way to go to establish their full credibility in the industry.

As our study revealed, people will often seek the advice of wealth specialists, particularly when important financial decisions have to be made or when actions are ready to be taken. This is despite the fact that most users still pay attention to financial influencers’ tips, recommended stocks, and investment guides.

This study took place between June 1st and June 8th, 2022, among 1,000 users in Spain, Germany, the Netherlands, France, and Belgium. We polled users that followed financial and wealth influencers in order to determine how much they trusted those influencers and how reliable they felt they were. The responses are anonymous.

The Sortlist Data Hub is the place to be for journalists and industry leaders who seek data-driven reports from the marketing world, gathered from our surveys, partner collaborations, and internal data of more than 50,000 industries.

It is designed to be a space where the numbers on marketing are turned into easy-to-read reports and studies.