Survey: Why COVID-19 Isn’t Igniting the Digitalisation of Europe’s SMBs

Published on: 05 Sep 2022 | Author: Raluca Zdru

Published on: 05 Sep 2022 | Author: Raluca Zdru

Since the outbreak of the pandemic, we’ve published several updates on the impacts of the ongoing health crisis based on our own industry data. This time, we decided to turn things around. We surveyed almost 500 owners and general managers of small and medium businesses (SMB) across Europe on how the pandemic is impacting their digitalisation.

At the beginning of the outbreak, commentators were quick to conclude that the measures to mitigate the spread of the coronavirus would have an obvious side effect: the acceleration of digitalisation. Nine months into the pandemic, Sortlist’s survey shows that things aren’t in fact that simple.

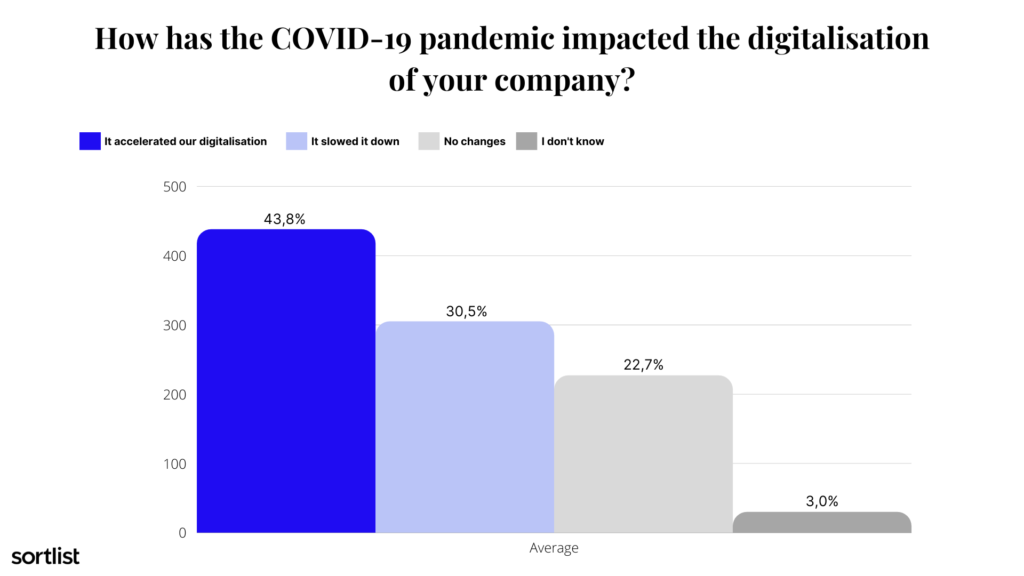

Across Sorlist’s European core markets – Belgium, France, Spain, and Germany – 43.8 % of SMB owners said the pandemic did, in fact, accelerate digitalisation efforts, whereas 30.5 % said it slowed it down. Another 22.7 % said there was no change at all.

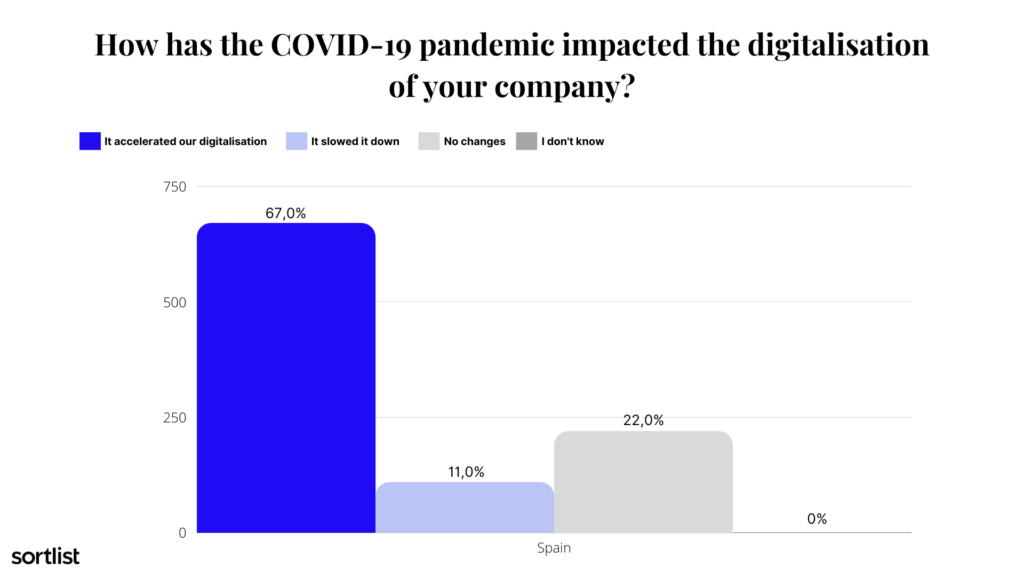

In Spain, an overwhelming majority of 67% of SMB owners said in our survey that the measures to mitigate the spread of the virus sped up their digitalisation efforts, while 11% said it slowed it down and 22% said they observed no impact on their company.

Spain is the only surveyed country where a majority of the business owners said that the COVID-19 pandemic did accelerate digitalisation.

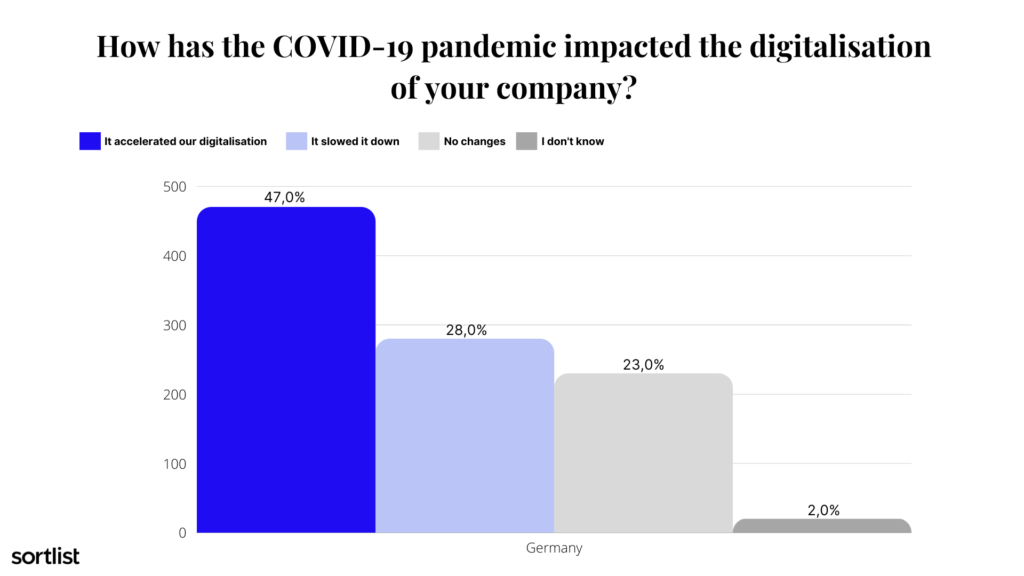

Germany fell short of the 50% threshold. 47% of business owners said their digitalisation picked up some speed, 28% said the opposite happened and 23% said there weren’t any changes.

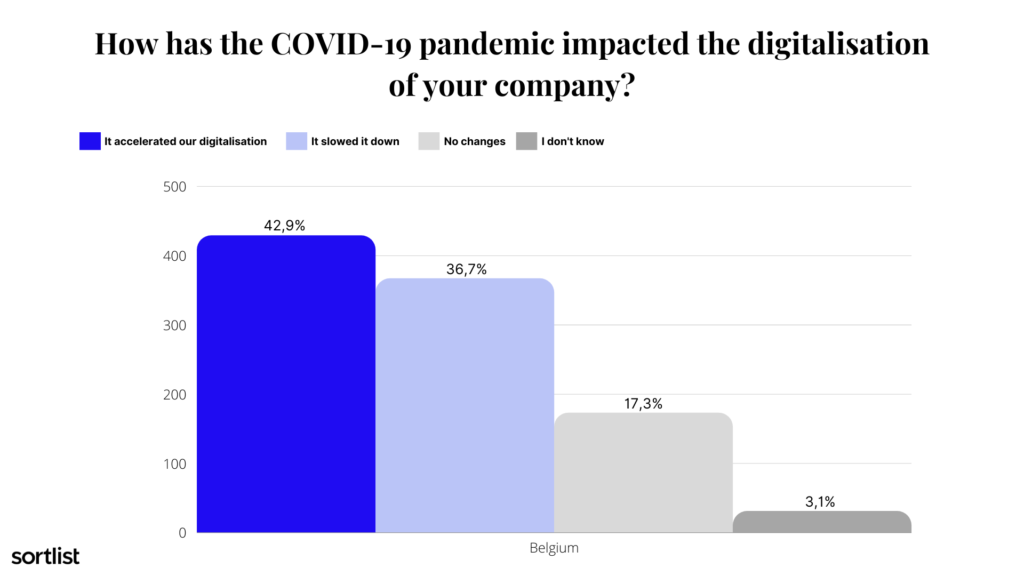

In Belgium, 42.9 % of SMB owners saw an intensified digitalisation at their companies, while 36.7 % say it slowed it down and 17.3 % say there were no changes.

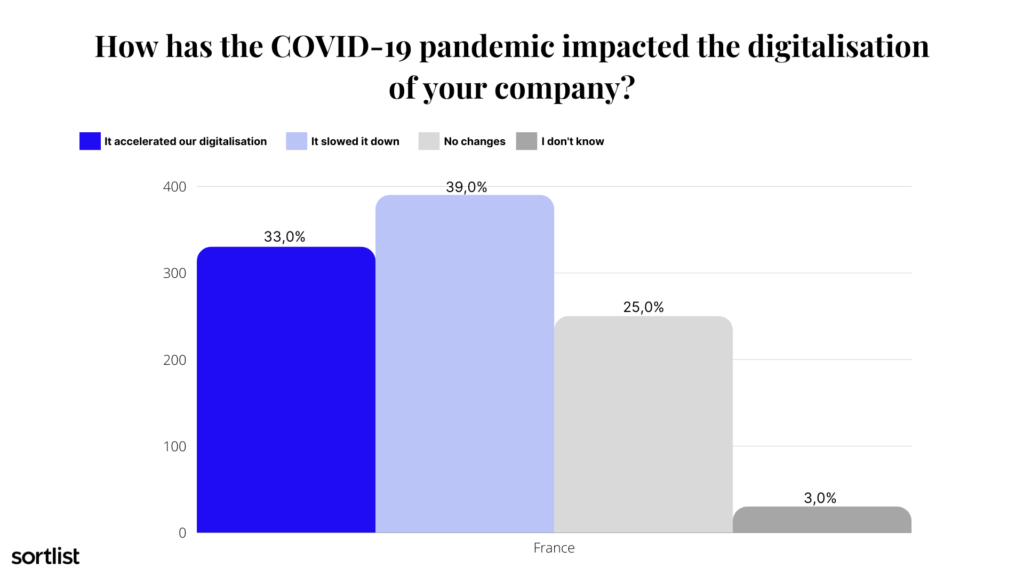

In France, 39% more business owners said the pandemic has slowed down digitalisation than it accelerated going digital (33%). A further 25% said nothing changed.

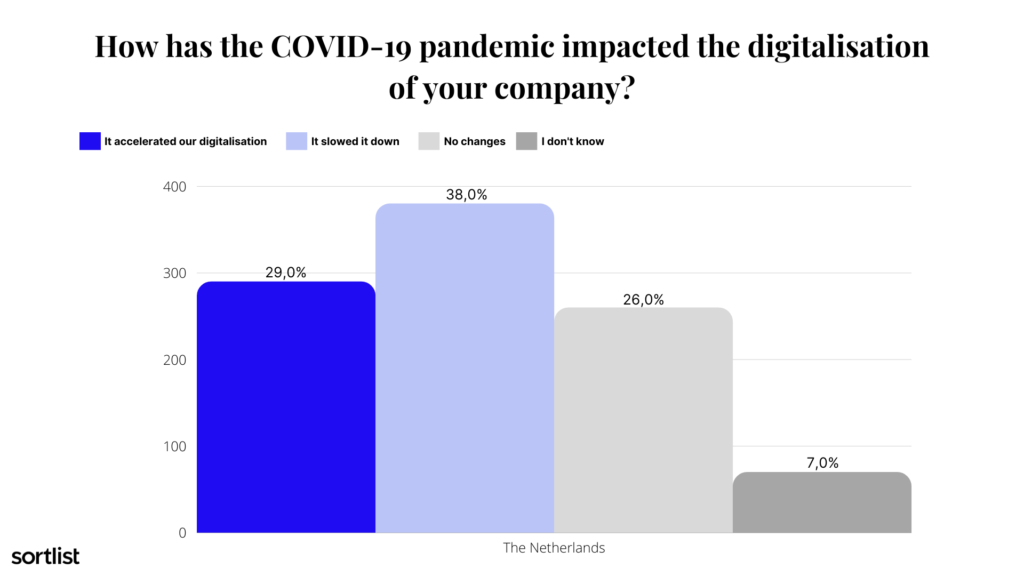

In the Netherlands, the results are very similar. 38% of SMBs saw a slowdown in digitalisation, while 29% saw an acceleration. 26% saw no changes.

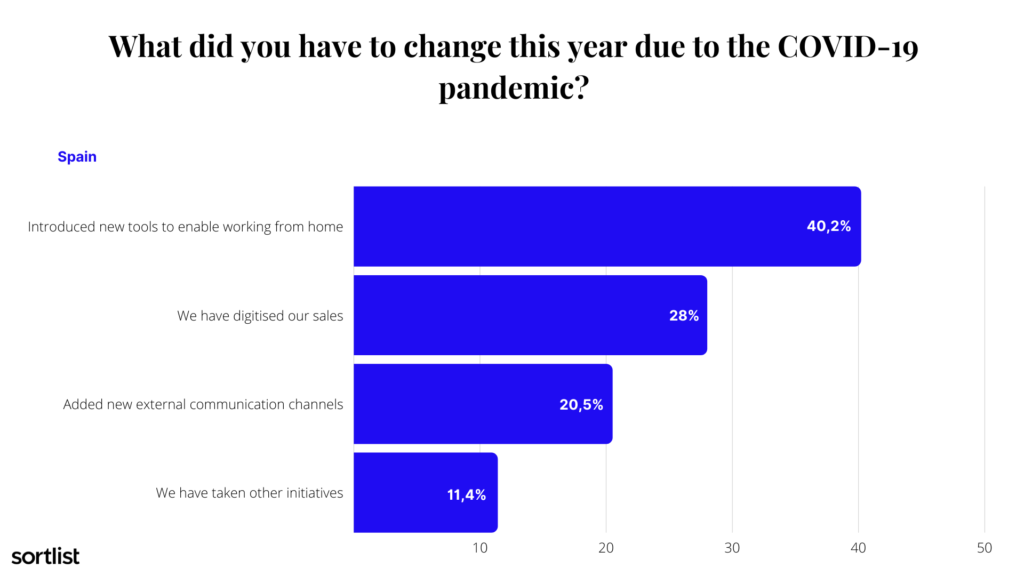

In Spain, a clear majority of SMBs said that COVID-19 pandemic positively impacted their digitalisation efforts.

40.2 % said they took additional measures to enable remote working during the lockdowns, 28% said they moved their sales online, 20.5 % added new external communication channels, and 11.4% took further measures.

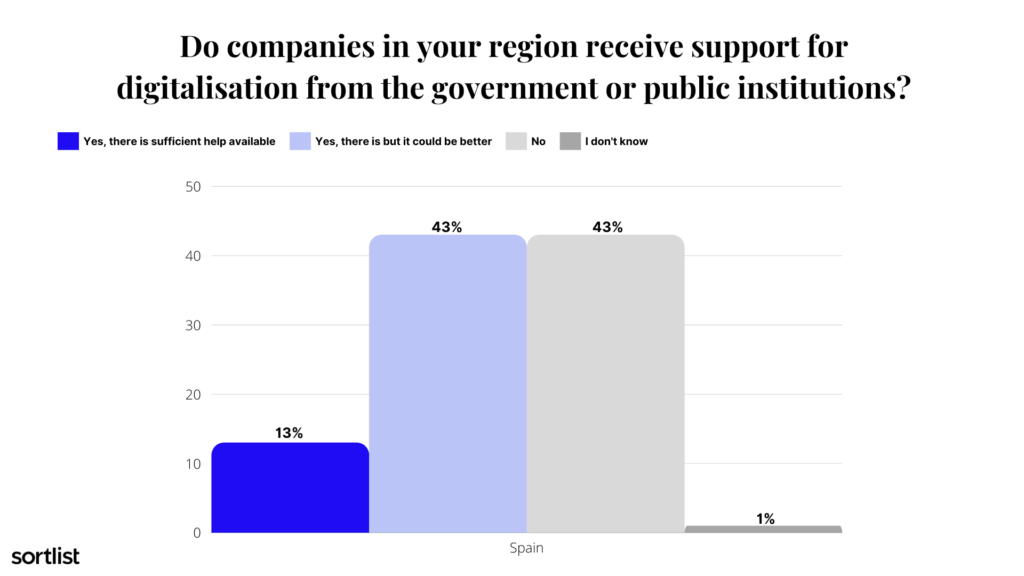

However, Spanish SMB owners often don’t feel sufficiently supported by the government and public authorities. 43,0 % say there is no help available and another 43,0 % say there is some help available with room for improvement. Only 13,0 % say there is enough help available.

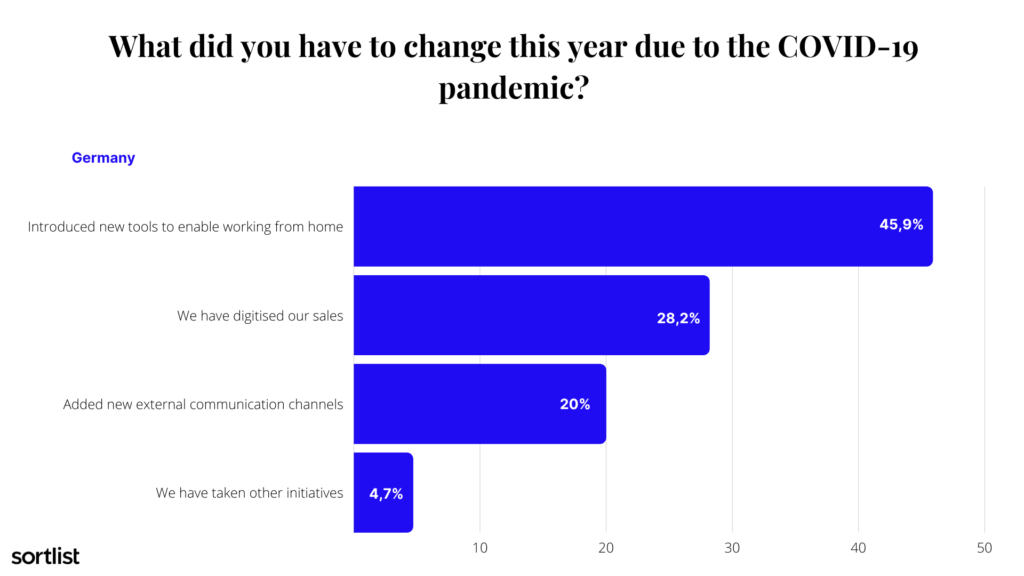

45.9 % of German SMB owners who saw an acceleration in digitalisation at their companies enabled working from home, 28.2 % moved their sales online and 20% added new external communication channels.

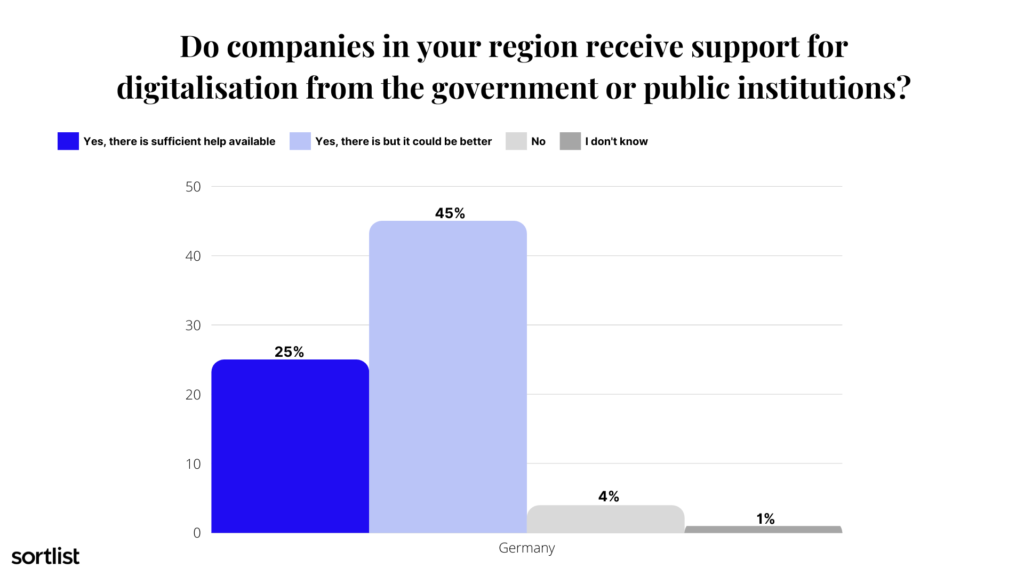

Compared to Spain, business owners in Germany are much more satisfied with government help. 25% say that there is no sufficient help available for their digitalisation efforts. Another 25% say there is enough support from public institutions, and a further 45% say there is some help available.

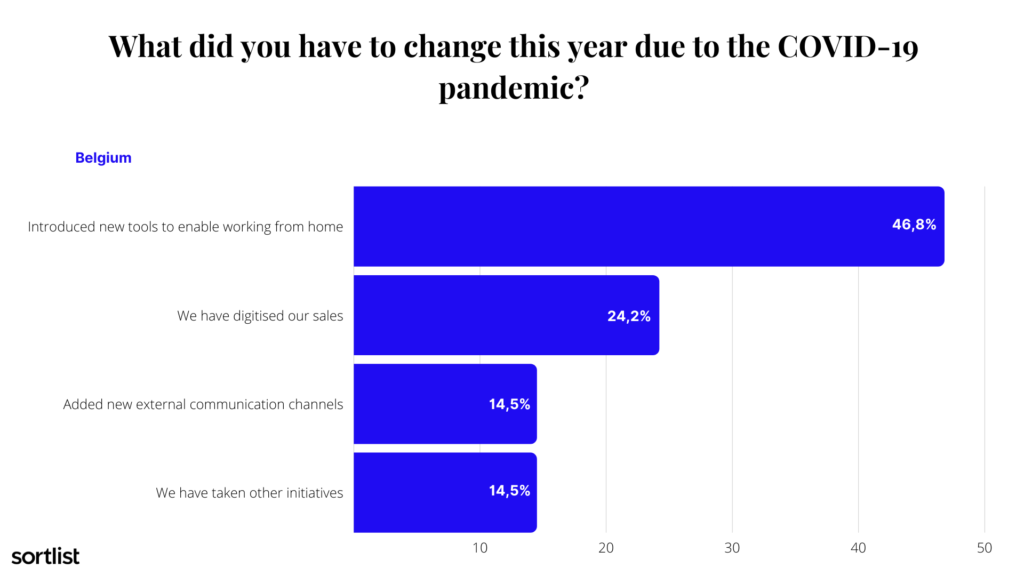

46.8 % of businesses that saw an acceleration in their digitalisation implemented additional measures to enable remote working. 24.2 % digitised their sales, 14.5 % added new channels to their external communication and another 14.5 % took other measures.

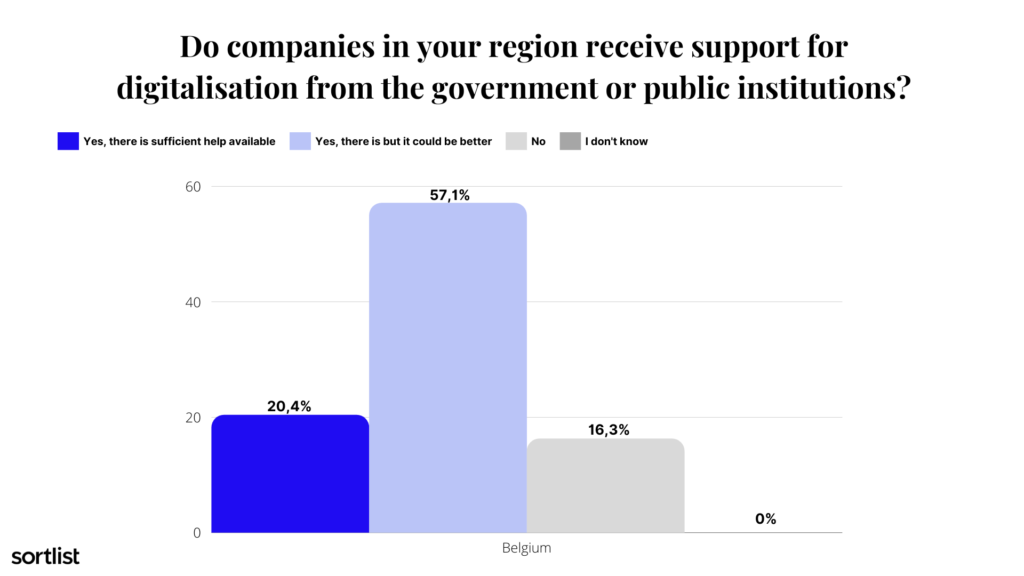

Belgian business owners are comparably satisfied with the availability of public aid with their digitalisation. Only 16.3 % say that there is no sufficient support, 57.1 % say there is some support and a further 20.4 % say that there is sufficient support available.

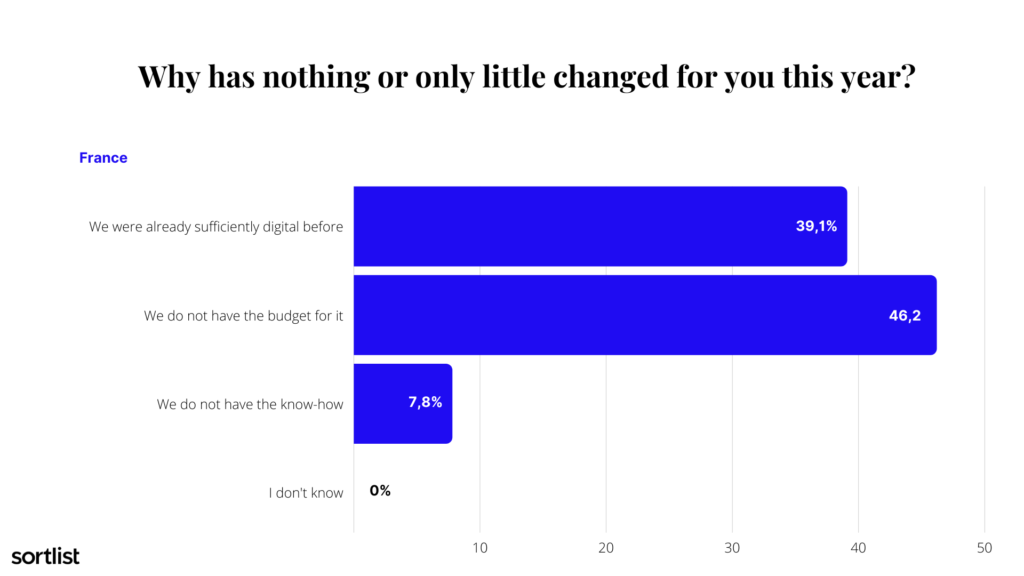

In France, the majority of SMB owners said that the pandemic had slowed down their digitalisation.

The main reason seems to be money. 46.2 % of those who said their digitalisation was either slowed down or unimpaired said that they didn’t have enough money for significant changes. 39.1 % said, however, that they were already digital enough to continue operating and 7.8 % said they lacked the expertise to enhance digitalisation.

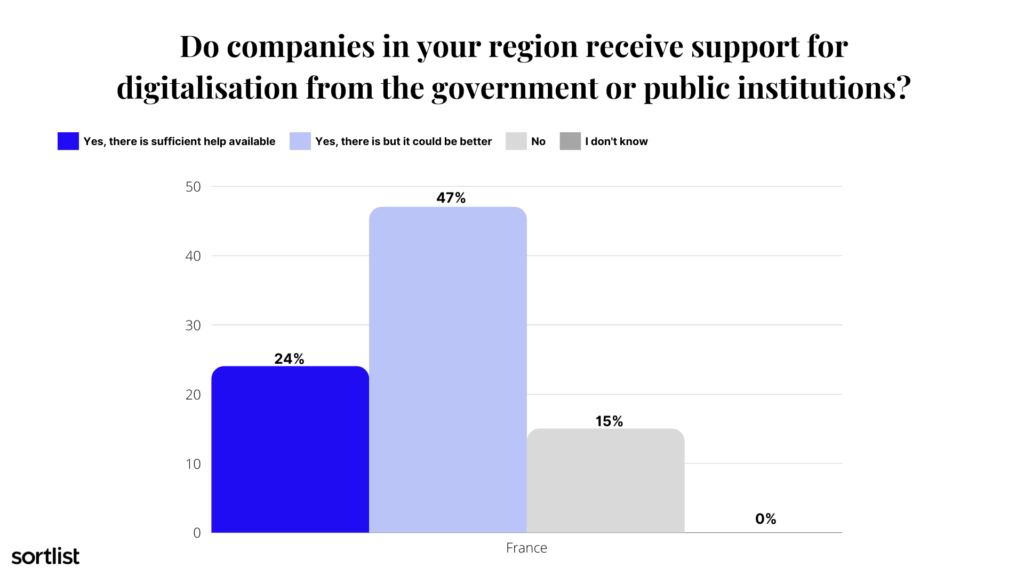

However, the French seem to be rather pleased with the availability of public aid. Only 15% say there is no sufficient help, whereas 47% say there is some available and 24% say there is enough public aid available.

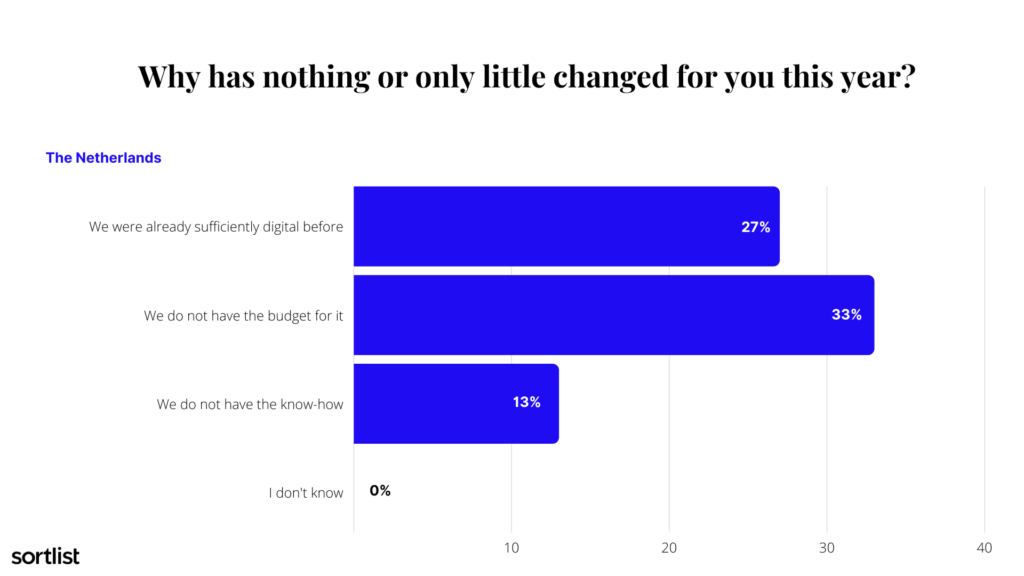

The results for the Netherlands are comparable to those of France.

However, fewer business owners in the Netherlands judged themselves sufficiently digital to make it through the crisis. 27% said they already had enough digital technology integrated.

33% of Dutch SMB owners said that a lack of money slowed their digitalisation down, and 13% said it was due to a lack of know-how.

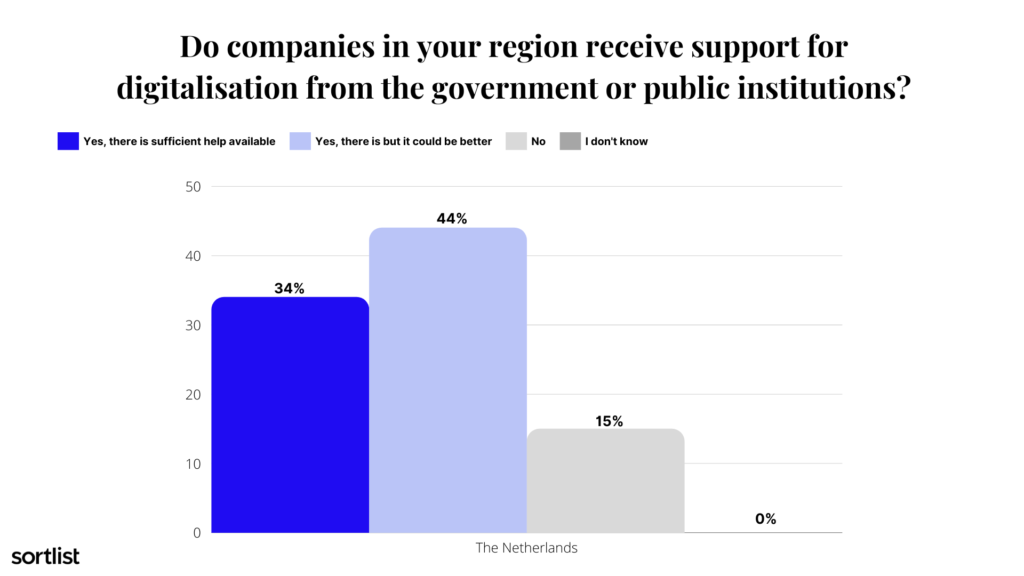

Entrepreneurs in the Netherlands seem to be rather happy with government support for their digitalisation. 34% say there is sufficient help available and 44% say there is some help available. 15% say there is no adequate support available.

Our survey does not show a clear result on whether the COVID-19 pandemic positively impacts the digitalisation of SMBs across Europe. This might have different reasons.

Our study additionally shows a clear correlation between the satisfaction of SMB owners with public aid and their ranking in the EU’s digitalisation report. Public bodies should hence continue those programs which work well and improve efforts where there is a lot of room for improvement.

The study on which this article is based was conducted between May 19th and May 21st, 2020. Specifically, Sortlist interviewed 500 SMBs, divided between France, Belgium, Germany, the Netherlands, and Spain. These SMBs are companies with less than 250 employees and do not exceed 50 million euros in annual turnover. Finally, the respondents of this study were either managing directors or owners of an SMB.

The Sortlist Data Hub is the place to be for journalists and industry leaders who seek data-driven reports from the marketing world, gathered from our surveys, partner collaborations, and internal data of more than 50,000 industries.

It is designed to be a space where the numbers on marketing are turned into easy-to-read reports and studies.